Table of Contents

Intro

If you are wondering how much you are going to be taking home at the end of the year, you need to factor in taxes and deductions. As the saying from Benjamin Franklin goes, “nothing is certain except death and taxes”.

On this webpage you can enter your Employment Income, Investment Incomes and Registered Account contributions to calculate your Federal and Provincial Taxes, Deductions and then your After-Tax Income.

The results will be estimates. There is a fair bit of complexity in calculating as you begin to factor in Basic Personal Amount (and its brackets), Provincial Surtaxes (eg. 2 levels in Ontario), stacking of various brackets between Federal and Provincial etc. That being said, this should give a close indicator.

The Calculator

Marginal and Average Tax Rates

If you are interested in understanding how to further calculate this yourself, read on, but before we dive into rates there some very relevant definitions to understand are your Marginal Tax and Average Tax rates:

Marginal Tax Rate = The marginal tax rate is the tax rate applied to the last dollar of income earned. It is based on a progressive tax system where different portions of income are taxed at different rates. This rate increases as taxable income increases because higher income brackets have higher tax rates.

Average Tax Rate = The average tax rate is the total amount of taxes paid divided by total taxable income. It represents the overall percentage of income that goes to taxes, rather than just the rate applied to the last portion of income.

RATES and CALCULATIONS Research

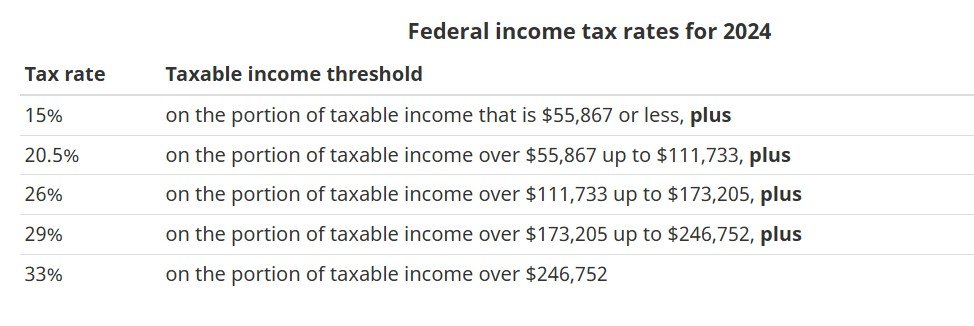

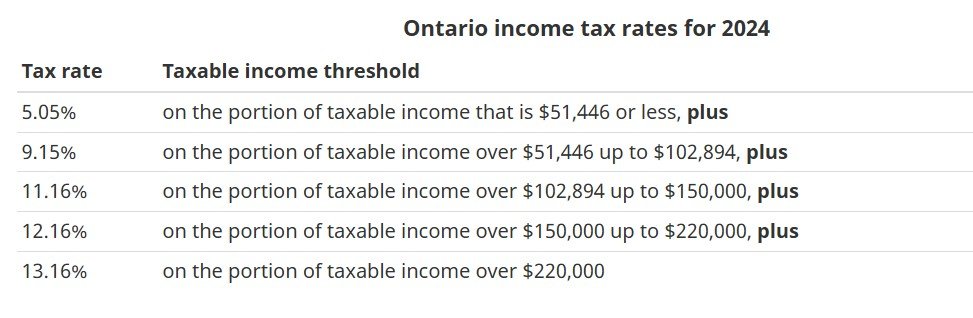

Federal & Provincial Tax Rates

Canadian Federal and Provincial Tax Rates in 2024 can be found at the Canada Revenue Agency (CRA) here: https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html.

If you are a resident of Ontario, these are the rates from the link provided above:

Provincial Surtaxes

But wait! Its not as simple as using the federal and provincial tables to calculate your combined rate. In some provinces you also need to account for Surtaxes.

For example, in Ontario, the 2024 surtaxes are:

- First Surtax: A 20% surtax is applied to the amount of basic Ontario tax that exceeds $5,554.

- Second Surtax: An additional 36% surtax is applied to the amount of basic Ontario tax that exceeds $7,108.

These surtaxes are calculated progressively. This means that as your basic Ontario tax liability surpasses the specified thresholds, the corresponding surtax rates are applied only to the portion of tax that exceeds each threshold.

Combined Federal and Ontario Tax Brackets

There is also a complexity in layering the tax brackets. If we look at a combined Federal and Provincial (Ontario) rate bracket it would look like:

|

Combined Federal and Ontario Tax Brackets (2025) |

|

|

Taxable Income Bracket |

Tax Rate (%) |

|

|

|

|

First $52,886 |

20.05 |

|

$52,887–$57,375 |

24.15 |

|

$57,376–$93,132 |

29.65 |

|

$93,133–$105,775 |

31.48 |

|

$105,776–$109,727 |

33.89 |

|

$109,728–$114,750 |

37.91 |

|

$114,751–$150,000 |

43.41 |

|

$150,001–$177,882 |

44.97 |

|

$177,883–$220,000 |

48.29 |

|

$220,001–$253,414 |

49.85 |

|

Over $253,414 |

53.53 |

Basic Personal Amount

We are not done yet!

You need to account for the Federal Basic Personal Amounts (BPA) tax credit.

The basic personal amount is a non-refundable tax credit that all Canadians can claim. Anyone generating an income at or below that amount will pay nothing in tax; anyone making more than that amount will get a partial reduction on their taxes based on the BPA figure.

In 2024 that amount is $15,705.

Some more details on BPA here : https://www.taxtips.ca/filing/personal-amount-tax-credit.htm

Other Amounts

Depending on your province you will also need to account for Health Care premiums, which are not accounted for above.

Capital Gains

Capital Gains: Only 50% of capital gains are taxable. If you sell an asset for a profit, half of the gain is added to your taxable income, and you pay tax at your marginal rate.

Eligible Dividends

Eligible dividends are paid by Canadian corporations that have been taxed at the general corporate tax rate. These dividends get a 38% gross-up, meaning the amount is increased by 38% for tax reporting purposes, and a larger dividend tax credit, reducing the overall tax owed.

Example:

• You receive $1,000 in eligible dividends.

• It’s grossed up by 38%, so it becomes $1,380 for tax reporting.

• Then, you get a dividend tax credit, reducing your taxes on this amount.

This makes eligible dividends more tax-efficient for investors compared to regular income.

Non-Eligible Dividends

Non-eligible dividends are paid by Canadian-controlled private corporations (CCPCs) that were taxed at the small-business tax rate rather than the general corporate rate. These dividends have a lower 15% gross-up and a smaller dividend tax credit, meaning they are taxed more heavily at the personal level.

Example:

• You receive $1,000 in non-eligible dividends.

• It’s grossed up by 15%, so it becomes $1,150 for tax reporting.

• You get a smaller dividend tax credit, meaning a higher tax bill compared to eligible dividends.

These dividends are less tax-efficient than eligible dividends but still receive some tax benefits.

Foreign Dividends

Dividends received from foreign companies (e.g., U.S. stocks) do not qualify for the eligible/non-eligible dividend tax treatment. Instead, they are taxed as regular income, meaning they are 100% taxable at your marginal tax rate.

Example:

• You receive $1,000 in foreign dividends.

• You pay tax on the full $1,000 at your regular income tax rate.

• Unlike Canadian dividends, it does not get grossed up or receive a dividend tax credit.

Additionally, foreign withholding taxes may apply (e.g., 15% withheld for U.S. dividends). If applicable, you may be able to claim a foreign tax credit to offset some of this tax.

Summing it all up

Therefore in order to get your Total Taxable Income, you sum up your Employment Income sources, and Investment Sources.

Do not forget to subtract out your Registered Contributions.

Calculate your Federal and Provincial Income taxes.

Subtract out your BPA.

This might be a bit simplified, but should get you a pretty representative total.

Once you have figured how much tax savings you will have :), check out the blog post on Budget and Expense Categories on how you can start getting your personal finances in order.

Online Resources

The results will be estimates. There is a fair bit of complexity in calculating as you begin to factor in Basic Personal Amount (and its brackets), Provincial Surtaxes (eg. 2 levels in Ontario), stacking of various brackets between Federal and Provincial etc. That being said, this should give a close indicator.

The Canada Revenue Agency (CRA) provides a large resource to research this.

Here are some links:

Home Page : https://www.canada.ca/en/revenue-agency.html

Federal and Provincial Brackets : https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html.

Another great online resource that has tonne of information is the folks at TaxTips.ca : https://www.taxtips.ca/