Table of Contents

Introduction

Would you like to convert CAD $ to USD $ or vice versa for the lowest possible fee’s? Norbert’s Gambit can help you achieve this blog outline how to implement it!

When you exchange currencies with your bank or brokerage you will incur a FOREX fee. That can range from about 1-3% and typically around 1.5%. Here is the deceitful part, you likely won’t see this cost listed on your account statements. The bank or online brokerage will adjust the retail currency conversion and is basically taking a hidden commission during the transaction. When converting larger sums, this fee can add up fast!

A typical Use-Case where you may encounter frequent and/or large sums of currency to convert is if you were for example a Canadian Individual looking to purchase a USD ETF or US listed security. That individual may have most of their cash in CAD, and need to convert a large sum to USD in order to purchase the security in USD.

If you simply buy these within your CAD brokerage account, you could incur forex fee’s on the purchase and then on the selling when it is converted back.

Did you know that you can avoid these conversion fee’s altogether? I have good news for you, with a method known as Norbert’s Gambit you could save thousands over time.

What is Norbert’s Gambit?

Norbert’s Gambit is a technique that lots of Canadian investors including myself use to cheaply exchange between CAD and USD currencies. The process involves buying a stock or ETF and selling it in another currency. This method avoids the high fees that brokerages charge for currency conversion.

Global X offers a product that is specifically tailored to this method which is DLR (Global X US Dollar Currency ETF) : https://www.globalx.ca/product/dlr

The ticker symbols for the Canadian dollar ETF is DLR.TO and the US dollar ETF is DLR.U.TO. You would buy and sell this just like any other ETF.

How do you execute Norbert Gambit?

3-Step Process for CAD $ to USD $

STEP 1:

BUY DLR.TO in your brokerage investment account.You will need to wait 2 business days for your trade to settle before proceeding to step #2.

STEP 2:

Exchange your DLR shares to DLR.U shares. This is a process called “Journaling”. This process can essentially the same at various brokerages but can look a bit different. More on that with examples below.

It will take about 1 business day for this process to complete before proceeding to step #3.

STEP 3:

SELL your DLR.U shares.This may take another 2 business days before your USD funds are available to use.

Global X’s brief overview can be found here: https://www.globalx.ca/insights/canadian-and-u-s-currency-exposure-using-etfs

Factor’s to consider when to use Norbert’s Gambit

Do use it if

- You are converting a large sum of dollars and want to minimize fees. Several online sources recommend over $1000 it starts to make sense, but I’d say more like $2000. The more you convert, the more you save.

- You do not need the funds immediately. The process can take up to 4-5 business days to complete.

Do not use it if

- You are converting $1000 or less. For the amount you will save, its not worth it.

- You are worried about currency fluctuation risk. Going from USD to CAD you have some minor currency fluctuations during the period of a couple days until you sell your DLR.TO.

- You need your funds ASAP.

Calculating the number of shares to buy

The number of shares you buy will depend on the amount of CAD (or USD) to convert.

DLR.TO Shares = (CAD$ Amount to Convert) / (DLR.TO Price)

Example calculation:

If attempting to convert $10000 CAD at the time of writing would be as follows.

CAD$ Amount = $10000

DLR.TO Price = $14.78

# DLR.TO Shares = 10000/14.78 = 676.59 rounding down to closest integer = 676 shares.

Norbert’s Gambit at Questrade

Questrade sent out the following communication on Jan 31st, 2025:

The process of buying and selling shares is the same as you would always do.

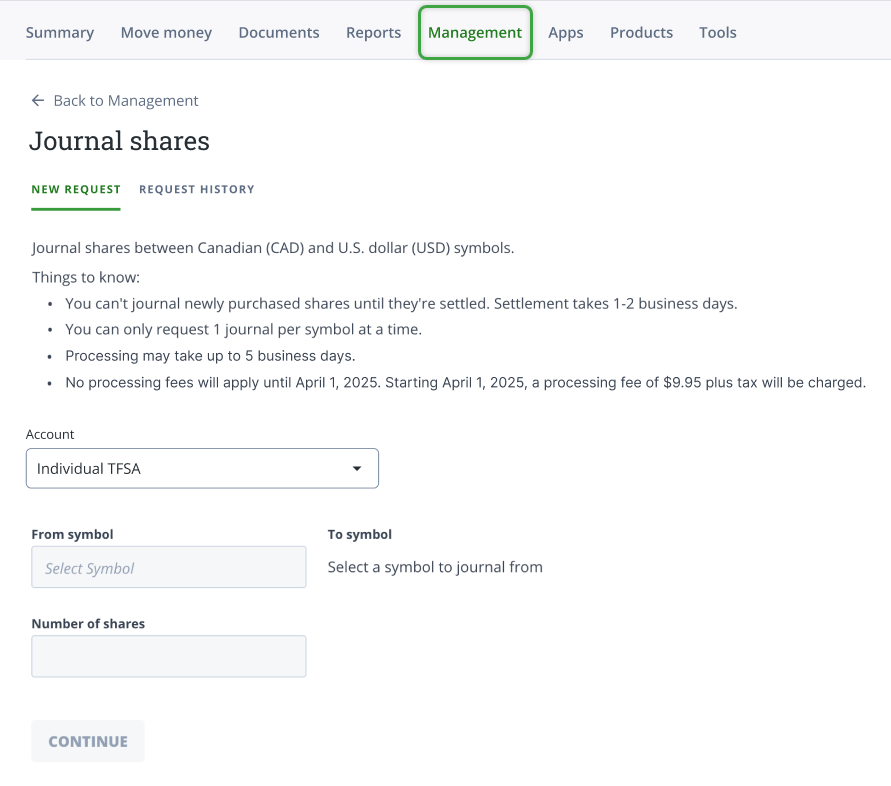

Placing a Journal request you go the Management page and then click Journal shares.

The screen should look something like this:

Questrade’s page providing an overview of their Journaling process : https://www.questrade.com/learning/investment-concepts/dual-listed-securities/journaling-shares

Norbert’s Gambit at TD Direct Investing

Norbert’s Gambit at TD is going to be a similar process. You will need a dual currency account setup.

The primary difference in the transactions I have done there is actually calling an agent to make the request to Journal the shares.

The cost at TD will be higher than Questrade as they have a $9.99 flat commission rate versus $0 at Questrade at of this blogs writing.

Summary

In summary, Norbert’s Gambit is a safe and effective way to save significant fee’s on currency conversion. With a little bit of research and getting comfortable with the journalling concept, you can say good bye to hefty bank forex fee’s.

Good luck with your currency exchanges!

If you are interested in the first step of getting your personal finances, check out the blog on Budget and Expense Categories.

For more tips and on visit the Personal Finance Blog.

Disclaimer : This blog is not financial advise. I am not a financial advisor. I am simply providing a method I have personally used to avoid hefty forex fee’s. Do your own research and happy investing!