Table of Contents

Introduction

Expense and Budget tracking is the cornerstone to any personal financial plan.

Even if you feel you do not need to “budget” understanding where and how much you are spending can be extremely valuable. More times than not, I think most will be very surprised looking back over the year, how much they spend on a certain category.

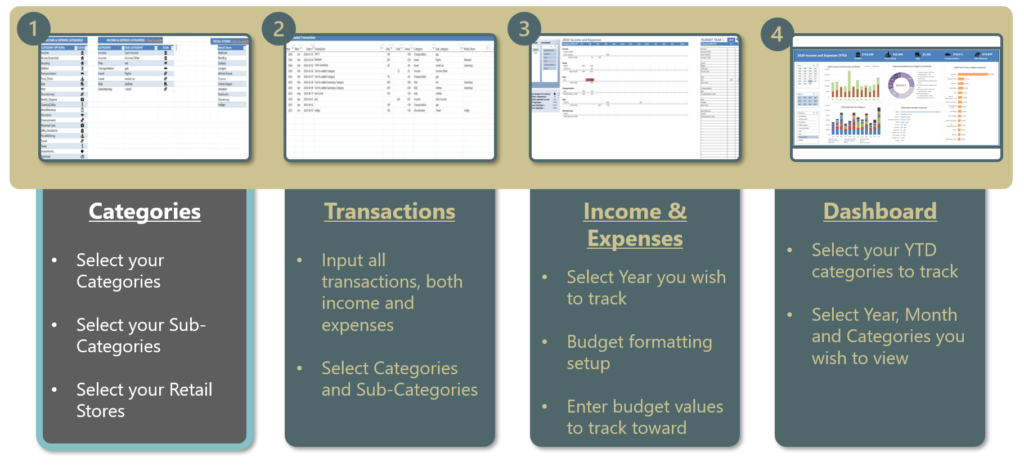

After 20+ years of fine tuning what actually works for our family, my solution which leverages Excel, consists of four main components, as outlined in the graphic below.

The starting point for any Expense and Budget analysis will be curating a comprehensive list of Categories and Sub-Categories that are aligned with where the majority of your money is allocated throughout the year.

Everyone’s Categories list will be slightly different as we are different in the way we live our lives. The Categories will as well change and evolve as you age. Major delta’s for me included going from single to married, managing a mortgage, getting a dog, having one child and then another etc.

The important thing is, you do give this step in building your budget some very careful consideration, as it will drive any further downstream analysis and summarization. You do not want to be flip-flopping on these as it will compromise the consistency of your transactions being categorized throughout the year, as well as across years.

CATEGORIES AND SUB-CATEGORIES LIST

I do think it is important to break your analysis into two tiers of Category and Sub-Category as well. It will allow you much more flexibility and incite for data analysis on your Income & Expenses spreadsheet and Dashboard.

It can be a bit overwhelming to brainstorm, so I have summarized a comprehensive list which I have tweaked and that has worked for my household for many years.

In total I use 10 Categories and as well listing 70+ sub-Categories for reference. The sub-categories denoted with an * are what I specifically use as of this writing, but have added some additional one’s that could be very applicable to others. As a reference, our household has two spouses, two children, which are now at post-secondary school, a dog, two vehicles and a residential home. Even if you have a very similar living situation, your thinking on how to “bundle” sub-categories maybe different and that is 100% ok. My only caution would be if you come up numerous additional categories in addition to the below. If you have a bunch that are less than 1% of your annual expenses, you may want to think about consolidating.

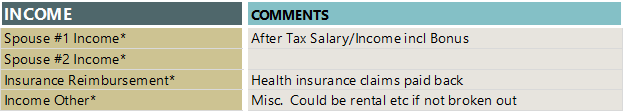

Income

I have specifically left out investment sources of income like Dividends and Bonds. Personally, I view that as part of an investment plan and have kept separate.

Sources of Income that could very well be added here could be from Rental properties, but again, I would like keep that part of a holistic investment plan rather than Personal Income and Budgeting.

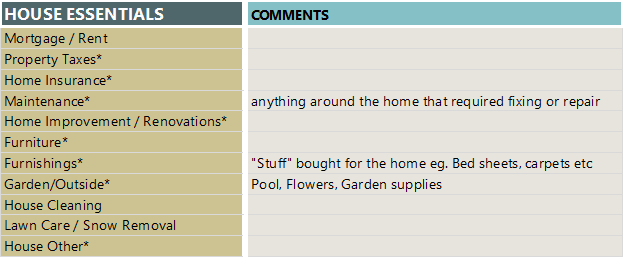

House Essentials

This category is an attempt to capture the main areas of expenses related to your dwelling which are not Utilities.

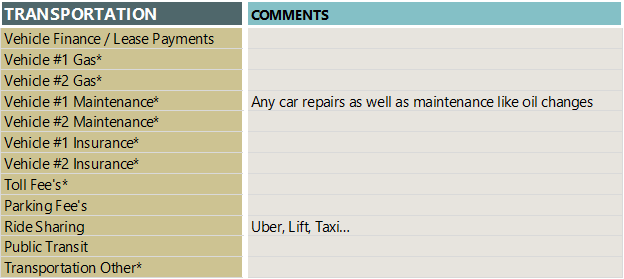

Transportation

Transportation is all expenses related to the household vehicles operation, and as well commuting.

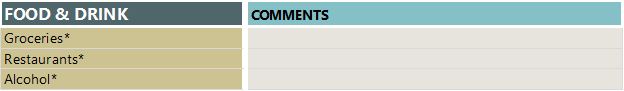

Food and Drink

This category has been updated over the years. Maybe a matter of personal preference how you capture your expenses but I decided to lump Restaurants and Alcohol here, but you could very well consider these as “Discretionary” items as well, and in fact use to have them under an “Entertainment” Category. Just another example of where I think most peoples solution to this can be different.

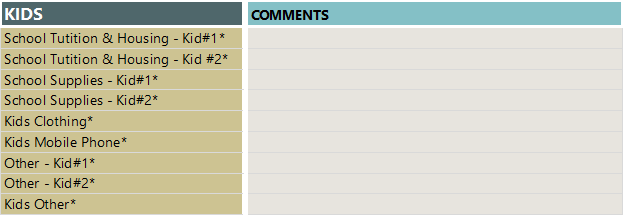

Kids

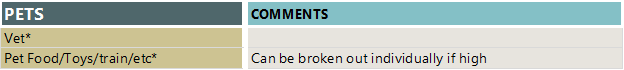

Pets

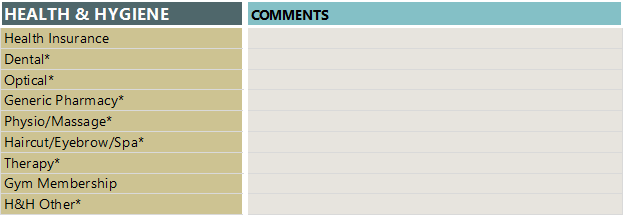

Health and Hygiene

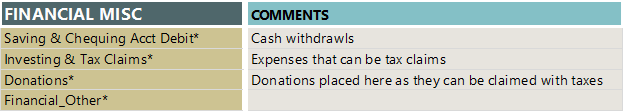

Financial Misc

Summary

You will note that for every Category, I have added a Sub-Category that is “Category Other” (except Utilities). Regardless of how much thought or detailed your categories are, there will be transactions and instances that just do not fit, and these ‘grab all’ sub-categories can be very useful for slotting those.

In short, if you pick your main Categories thoughtfully, unless you have a life event change that drives in a new category, eg, you had a child, it should be rare that you can’t fit in a transaction at all.

Hopefully this Category and Sub-Categories list provides inspiration for your own Expense and Budgeting solution! Good luck!